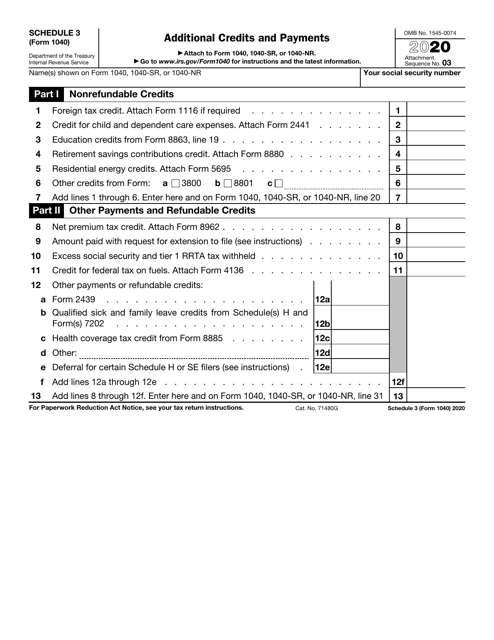

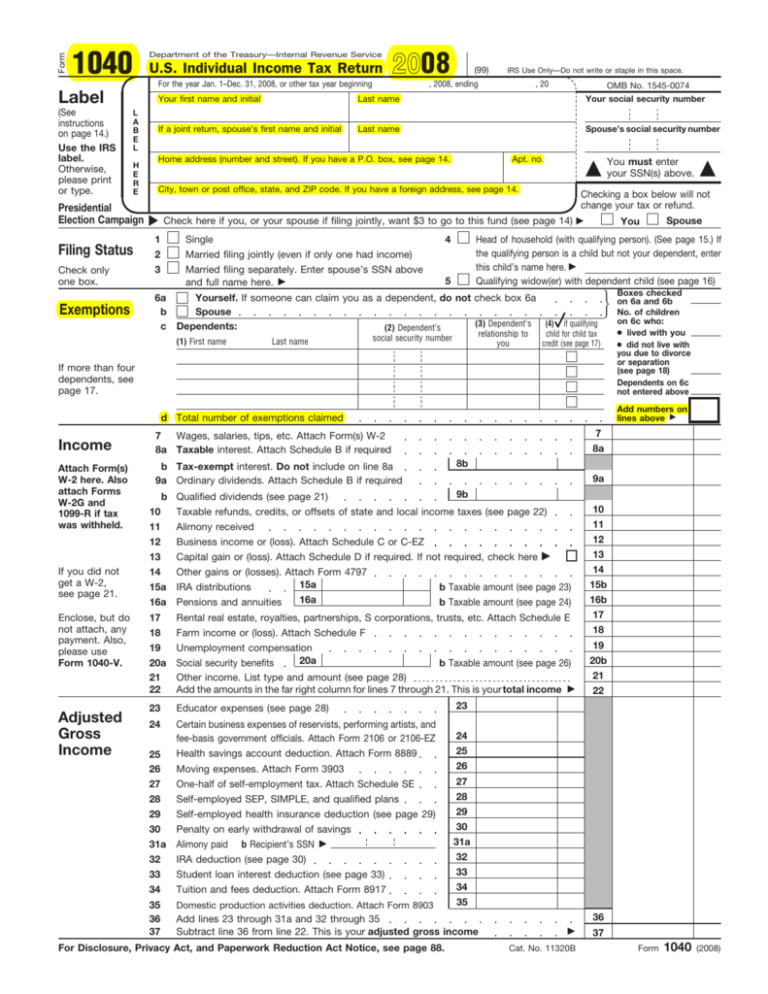

Similarly, those who want to claim itemized deductions on their 1040 have to complete Schedule A. Taxpayers who receive dividends that total more than $1,500, for example, must file Schedule B, which is the section for reporting taxable interest and ordinary dividends. Many individual taxpayers, however, only need to file a 1040 and no schedules. Some individuals may now need to file one or more of six new supplemental schedules with their 1040 in addition to long-standing schedules for such items as business income or loss, depending on whether they're claiming tax credits or owe additional taxes.

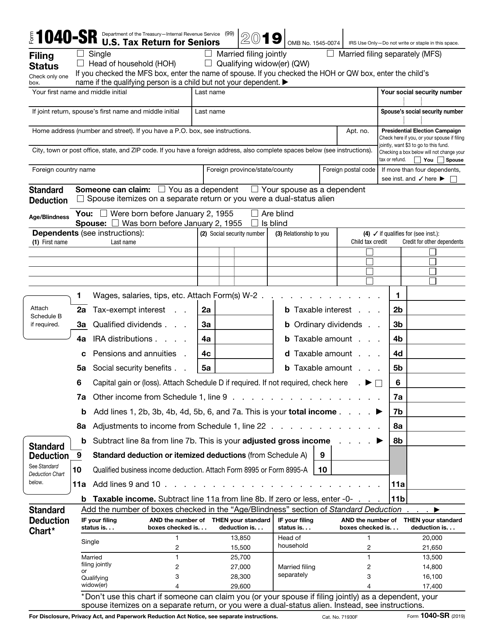

The new 1040 uses what the IRS terms a "building block" approach and allows taxpayers to add only the schedules they need to their tax return. The new tax legislation eliminated many deductions, including for unreimbursed employee expenses, tax-preparation fees, and moving for a job (except for military on active duty). Married filing jointly, $1,300 for each spouse who is 65 or older or blind. Single or head of household filers, $1,650

Married filing jointly or a qualifying widow(er), $24,800Īn additional deduction may be taken by those who are age 65 or older or blind (see "Age/Blindness" on the first page of Form 1040): Single or married filing separately, $12,400 Married filing jointly or a qualifying widow(er), $24,400įor the tax year 2020, which will be filed in 2021, the numbers have increased and are as follows: Single or married filing separately, $12,200 For 2019, these deductions are as follows: It also allows filers to claim the new higher standard deduction introduced with the Tax and Job Cuts Act. The 1040 income section asks the filer to report wages, salary, taxable interest, capital gains, pensions, Social Security benefits, and other types of income.

The form also asks about full-year health coverage and whether the taxpayer wishes to contribute $3 to presidential campaign funds. Form 1040 can be mailed in or e-filed.įorm 1040 prompts tax filers for information on their filing status, such as name, address, Social Security number (some information on one's spouse may also be needed), and the number of dependents. All pages of Form 1040 are available on the IRS website. The 1040 form for the tax year 2019, which will be filed in 2020, includes two pages to fill out.

Everyone who earns income over a certain threshold must file an income tax return with the IRS (businesses have different forms to report their profits). Form 1040 needs to be filed with the IRS by April 15 in most years.

0 kommentar(er)

0 kommentar(er)